The idea of daylight savings was that of Benjamin Franklin during his time as an American delegate in Paris in 1784. Some of Franklin ‘s friends, inventors of a new kid of oil lamp, were so taken by the scheme that they continued corresponding with Franklin even after he returned home.

Prior to 1883, the time of day was a local matter – most cities and towns used some form of local solar time maintained by a well-known clock (think Back to the Future). The use of standard time increased as people began to see the obvious benefits for communication and travel. Time zone changes have changed greatly since their introduction and continue to do so.

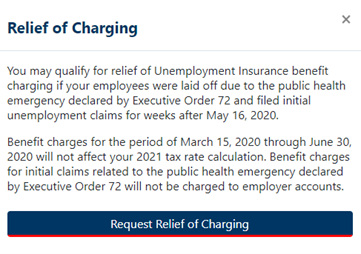

Daylight Savings Time has been used in the U.S. and in many European countries since World War I at some level – including “War Time” from 1942 to 1945. On April 12, 1966 President Johnson created Daylight Saving Time to begin on the last Sunday of April and end the last Sunday of October unless a specific state wanted to be exempt – they could by passing a law.

President Nixon, on January 4, 1974 signed into law the Emergency Daylight Saving Time Energy Conservation Act of 1973, set ahead until October 5, 1974. There have been multiple changes since then to where we are today – Daylight Saving Time in the U.S. begins at 2 a.m. on the second Sunday of March and ends at 2 a.m. on the first Sunday of November.

The state of Arizona is the only U.S. state that does not recognize Daylight Saving Time, along with approximately 70 other countries including Japan, India and China.

Now back to Benjamin Franklin’s idea of Daylight Saving Time – was it simply a scheme to increase demand in his electricity and thereby increase his profits?? I must admit the idea of saving daylight sounds appealing, but we need to remember that just like time – daylight passes us by whether we have used it wisely, wasted it or saved it. Happy Fall y’all!!