The State of Wisconsin sometimes allows companies to “purchase” a lower unemployment insurance tax rate. Wisconsin Pay has done the calculations on behalf of our clients and will be sending you an email if it pays for you to buy down your 2022 rate. This service has been provided at no charge to you by your Payroll Department (a/k/a Kayla and Katie at Wisconsin Pay Specialists).

If your company will save money by making the voluntary contribution, you will receive an email from service@wisconsinpay.com that will include the amount required to be paid to lower your rate and the tax savings. You can go online and make this payment yourself or contact us and we’ll make it for you for a fee of $35.

The Voluntary Contributions must be made no later than NOVEMBER 30 in order to lower your 2022 rate. If, you want us to make the payment on your behalf, we need to hear from you no later than Friday, November 26.

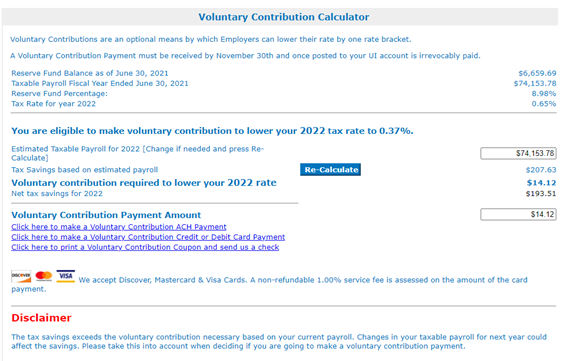

Here is an example of an employer whose Reserve Fund Percentage is 8.98% (which is close to the next level of 9%). By making a contribution of $14.12 – this employer will save $193.51 on its 2022 Unemployment Insurance Tax. They paid the $14.12. The best one we found was a client who had to pay 90 cents and saved $860.00! Happy Thanksgiving!!